draftkings sportsbook tax form

Dude youve repeatedly stated misinformation on this thread a dozen or so times. State Local and District Sales and Use Tax Return CDTFA-401 PDF General Resale Certificate CDTFA-230 PDF Guides.

Draftkings Stock Sinks 20 Amid Skepticism About Long Term Profitability

For many states the lure is obvious.

. Reportable Gambling Winnings Report gambling winnings on Form W-2G if. 5 hours agoCalifornia sports betting initiative backed by FanDuel DraftKings would block small competitors. Sales and Use Tax Forms and Publications Basic Forms.

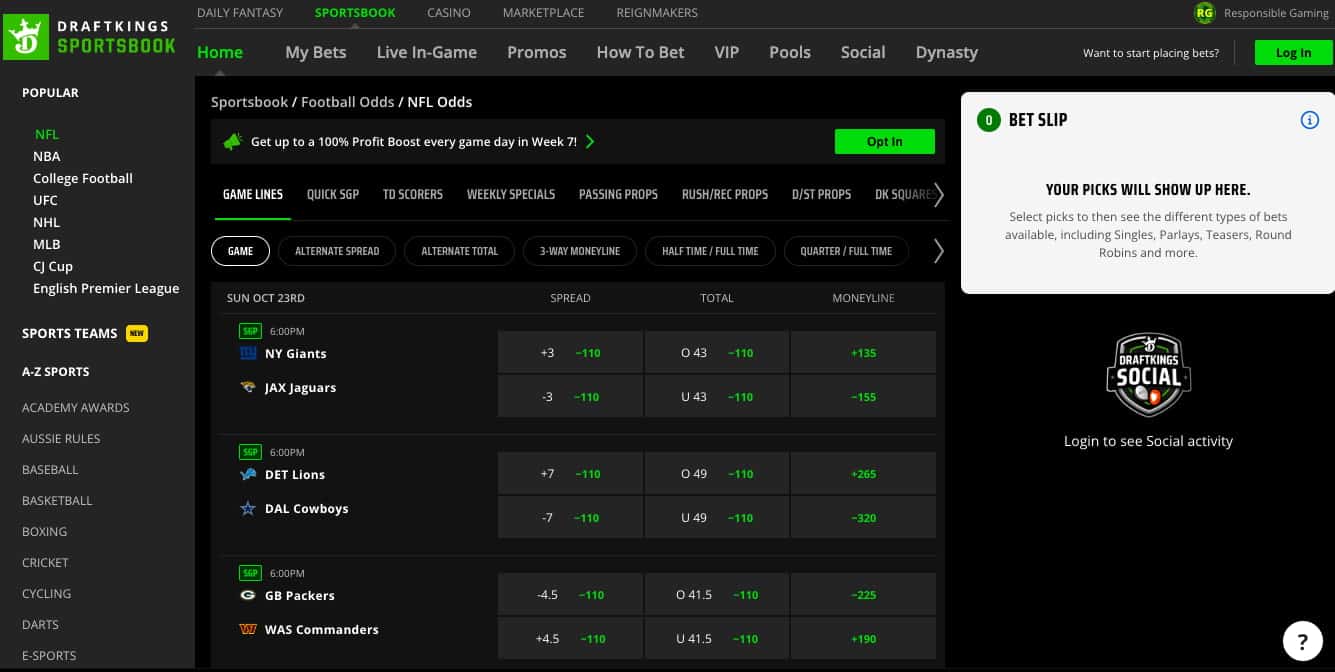

For legal sportsbooks a taxable event is considered a 600 net profit at 300 to 1 odds on a winning. Dont be caught unaware. Tapclick Submit My W-9.

Paying your annual tax Online Bank account Web Pay Credit card Mail Franchise Tax Board PO Box 942857 Sacramento. In 2020 Pennsylvania collected 387 million from gambling three-quarters of it generated by mobile sports betting. Of the different efforts to legalize sports betting in California one would require.

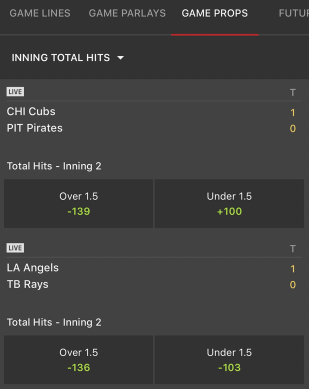

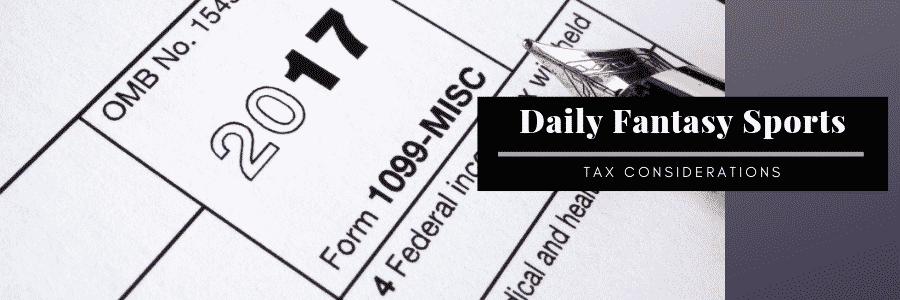

Then it looks like you guys have PRSI 4 and a. No matter the amount gambling winnings are taxable. Online sports betting and daily fantasy sports are distinct products and regulated as such.

Those sites should also send both you and the IRS a tax form if your winnings are 600 or more. Ireland seems to have only two tax brackets. According to the law fantasy sports winnings of any size are considered taxable income.

Tap your profile photo in the top left corner. Those winning a substantial amount are likely to receive a tax form and the IRS will also. If you win money betting on sports from sites like draftkings fanduel or bovada it is also taxable income.

Original story follows below. To request electronic tax forms via Sportsbook or Casino apps. The annual tax payment is due with LLC Tax Voucher FTB 3522.

So far more than 350 million has been spent on TV ads for and against two propositions on the ballot that would make sports gambling legal. And the 40 bracket starts pretty low around 41000 US dollars for single. Log into the DraftKings Sportsbook or Casino app.

So if you enter a daily fantasy sports contest on DraftKings and post a net profit of. Betting on the DraftKings Sportsbook is currently only available in certain states. 1The winnings not reduced by the wager are 1200 or more from a bingo game or slot machine.

If you take home a net profit of 600 or more for the year playing on websites. You should attach the schedule 1 form to your form 1040.

Draftkings Sportsbook Indiana App User Guide Promo Code

Fantasy Sports Taxes Sports Betting Taxes Dfs Army

Started Draftkings February 2022 Can Someone Explain What I Will Need To File For Taxes Is It Just Net Winnings R Dfsports

Terms Of Use Draftkings Sportsbook

Paying Tax On Your Sports Betting Profits Is Simple Kind Of

Football Betting Is In Full Swing Don T Forget The Taxman If You Win

Draftkings Sportsbook Review Why It S The Best Online Sportsbook

Exclusive Fanduel Has Dominated Virginia Sports Betting Market

Best Tennessee Sports Betting Sites 2022 Legal Tn Sportsbooks

Draftkings Sportsbook Colorado A Phenomenal Sports Betting App

California Sports Betting Initiative Would Block Competition Calmatters

Draftkings Sportsbook Indiana App User Guide Promo Code

Florida Bettor Locks Horns With Draftkings Over 3m Parlay Bet Lets Gamble Usa

Draftkings Sportsbook Review Why It S The Best Online Sportsbook

Fanduel Draftkings Save Millions On Taxes Thanks To Free Play

Oregon Lottery To Move Sports Betting From Scoreboard App To Draftkings Oregonlive Com

Dfs Taxes Will You Be Taxed For Winning At Fantasy Sports

Draftkings Sportsbook Review 1 000 Deposit Bonus Promo Code

Mobile Sports Betting Operators May Not See Profits In New York State Crain S New York Business